Salon is one of the finest that Champagne has to offer – a luxury product of dimensions. And while inflation is a reality in the world economy, luxury goods have historically performed strongly in times of crisis. Read the full story.

Estimated reading time: 2 minutes

Three Reasons Why You Should Invest In Champagne:

- By 2025, China is expected to become the largest market for luxury goods. Similarly, the wine market in China is expected to double by 2026, and affluent, Western-oriented millennials and Gen Zers are expected to drive demand.

- Champagne sales are reported to have increased in the first half of 2022 compared to the previous year, and the Champagne Committee is expected to announce record sales for 2022. The massive demand has even led Moët to run out of champagne.

- The difficulties with demand and supply in 2022 have led the Champagne Committee to raise the permitted harvest for 2022 – the only challenge is that the big Champagnes are aged for ten years, so it will be a long time before this has any real effect.

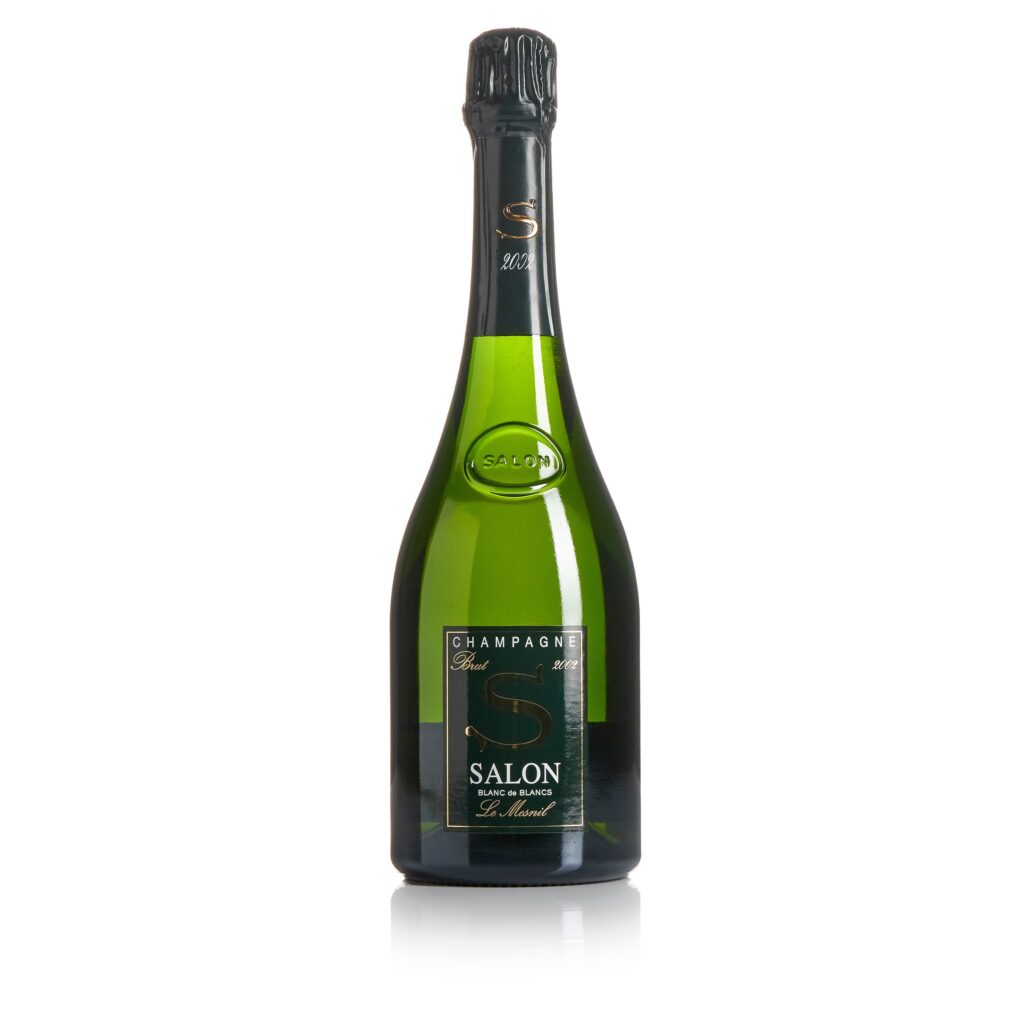

Salon: in short according to RareWine;

- In 1905, Eugéne-Aime Salon presented its first vintage Champagne made exclusively from Chardonnay – the world’s first Blanc-de-blancs and the world’s first Salon.

- Eugéne was uncompromising and therefore Champagne Salon was only released when the quality allowed – and only in around 60,000 bottles per vintage. It remains so – Salon is therefore only for an exclusive few.

- Since 1905, only 43 vintages of Salon have been produced, and the 2002 vintage is one of the top five vintages with a rating from the world’s top critics* of 96 points.

- In five years, Salon 2002, which is managed by RareWine Invest, has returned 267%. Although this return is exceptional, there is no indication that demand for Salon is diminishing – quite the contrary.